As 2025 winds down, the $18,000 annual gift tax exclusion offers a powerful way to reduce your estate while funding family futures.

For American’s with $250K+ in assets, gifting shrinks taxable estates before the Tax Cuts & Jobs Act (TCJA) sunset potentially doubles taxes in 2026. With 70% of Americans lacking plans, this simple move saves heirs thousands.

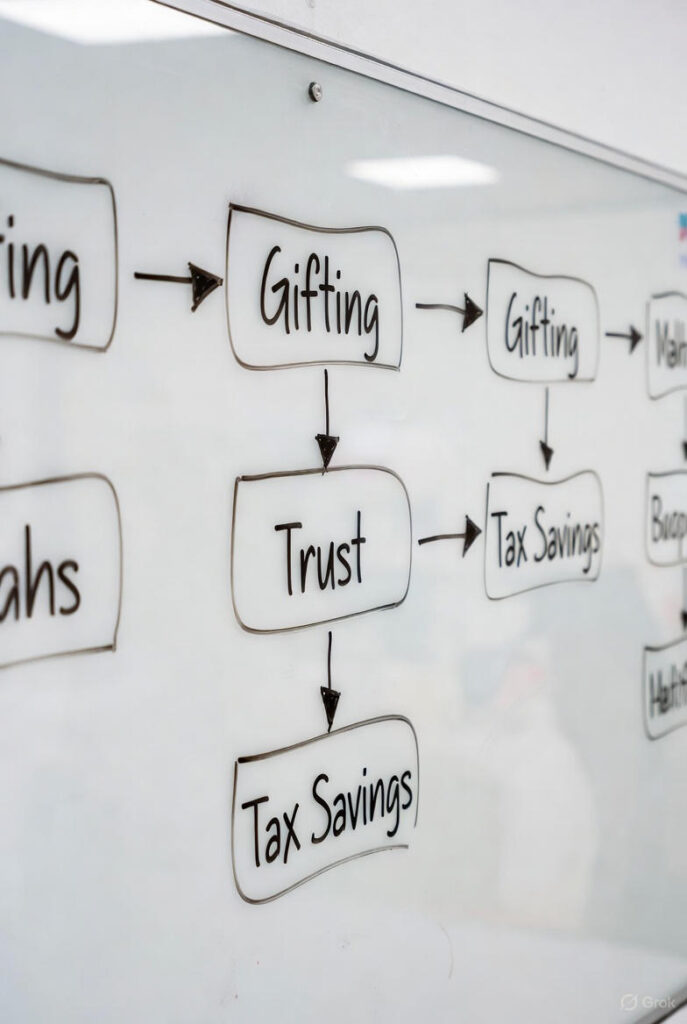

At Davenport & Associates, we integrate gifting into trusts for maximum impact. What is the 2025 gift tax exclusion? It’s $18,000 per recipient ($36,000 for couples) tax-free. This article shares strategies to maximize it before year-end. How to gift for retirement security? Read on to protect your legacy.

What counts as a gift? Cash, property, or forgiven loans up to $18K/person annually without reporting. Why before 2026? The Tax Cuts & Jobs Act (TCJA) sunsets, possibly halving exemptions and triggering 40% taxes on estates over $7M. Benefit? Gifting reduces your estate, preserving more for heirs without IRS scrutiny. For retirement? It frees assets for IRAs or annuities, aligning with 58% savings gaps.

How to start? Gift $18K to each child, grandchild, or even in-laws—couples double to $36K. Example? $18K to a grandchild’s 529 plan grows tax-free for education. Pro tip? Track via trusts to avoid double-counting in estates.

Why gift now? Lifetime exemption is $13.61M (2025), but sunsets to ~$7M. Advanced move? Use “Crummey” letters in irrevocable trusts for annual gifts, locking exemptions. Impact? Reduces future taxes by 40%, ideal for blended families or Gen Z heirs.

How do trusts enhance gifting? Revocable trusts gift without losing control; irrevocable ones remove assets from your estate. Year-end tip? Gift via trusts to shield from Medicaid or creditors, saving 4-7% probate fees.

| Strategy | Amount Allowed | Benefit |

|---|---|---|

| Annual Exclusion | $18K/person ($36K/couple) | Tax-free, reduces estate |

| 529 Education Gifts | $18K/person (5-year frontload $90K) | Grows tax-free for grandkids |

| Crummey Trust Gifts | $18K/person annually | Locks lifetime exemption early |

| Integrate with Trusts | Unlimited via irrevocable | Asset protection, probate avoidance |

What if I exceed $18K? Report on Form 709—no tax until lifetime limit.

For non-family? Same rules—great for charities.

The $18K limit is your 2025 opportunity to slim your estate tax-free. Don’t miss it—70% do. Ready to gift strategically? Schedule a free consultation below.

John F. Davenport, founder of J. Davenport Advisors and Davenport & Associates in Norwalk, CT, is a licensed attorney in New York and Connecticut with more than 30 years of experience as a financial advisor and investment advisor. He specializes in helping Americans maximize retirement income, explore tax-efficient strategies, implement in-plan annuity and hybrid solutions, and build lasting legacies for their heirs through thoughtful wealth planning.