The world of finance, investments, and wealth management can be hectic and is constantly changing. Davenport & Associates is here to provide content and insights to help you stay on top of the latest information and how it could affect your current plans and strategies.

Estate Planning 101: The 5 Essential Documents Everyone Needs

The Foundation of Every Solid Estate Plan Think estate planning is only for the ultra-wealthy? Think again. Whether you have $50,000 or $5 million, these five core documents protect your wishes, your family, and your assets. At J. Davenport Legal, we’ve helped thousands create them in one simple package. What are the five essential estate… View Article

READ MORE

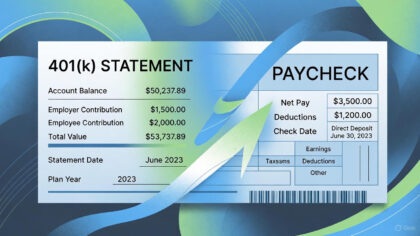

Retirement Readiness: 2025 Trends in Catch-Up Contributions

The Super Saver Boost You Can’t Ignore If you’re 50+, 2025’s catch-up contributions offer a massive opportunity to supercharge your nest egg before year-end deadlines. With 58% of Americans behind on savings and the Tax Cuts & Jobs Act (TCJA) sunset looming, these enhanced limits can add thousands tax-deferred. At Davenport & Associates, we help… View Article

READ MORE

Protecting Your Home for the Holidays: Medicaid Planning Before 2026

Keep Your Home in the Family This Holiday Season As families gather for the holidays, many over 50 worry about long-term care costs forcing a home sale—Medicaid’s 5-year look-back can claim your biggest asset if unplanned. With 50% of retirees facing $100K+ care bills and 2026 rules tightening, protecting your home is urgent. At J…. View Article

READ MORE

Thanksgiving Family Talks: How to Discuss Retirement & Legacy in 2025

Turn Thanksgiving Dinner into a Legacy Conversation As families gather this Thanksgiving, it’s the perfect moment to talk about retirement and legacy—yet 68% avoid these discussions, per TIAA’s 2025 Holiday Survey, leaving wishes unspoken and plans incomplete. For most Americans, these talks ensure your hard work benefits loved ones, not courts or taxes. At Davenport… View Article

READ MORE

Discussing End-of-Life Preferences: Insights from Pew’s 2025 Survey

The Conversation Too Many Avoid End-of-life Preference discussions can feel uncomfortable, but a 2025 Pew Research survey reveals a startling gap: only 43% of Americans over 50 have talked preferences with family, leaving 70% without clear directives amid rising longevity and care costs. For most Americans, this silence risks unwanted treatments or family conflicts. At… View Article

READ MORE

Annuities Inside 401(k)s in 2025: New Guaranteed Income Options

Your 401(k) Just Got a Pension Upgrade In 2025, a quiet revolution is happening inside millions of 401(k)s: annuities are now the fastest-growing plan feature, with 42% of large plans offering them—the highest ever. New DOL and IRS rules make it easier than ever to turn part of your retirement savings into guaranteed lifetime income… View Article

READ MORE