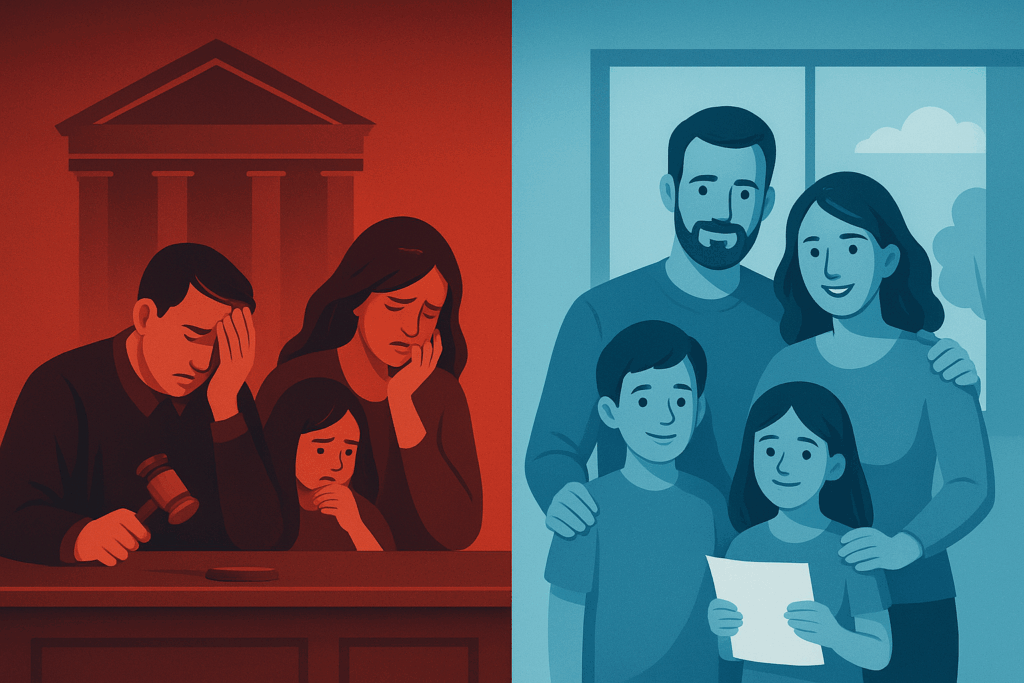

Imagine your family facing court battles and frozen bank accounts after your passing—all because you didn’t have a simple estate plan. For the majority of Americans, this is a real threat.

At J. Davenport Legal, we help you avoid these pitfalls with straightforward tools like wills and trusts. What are the two biggest problems without an estate plan? Dying intestate (without a will or trust) and probate (court validation of your will).

These issues affect 70% of Americans without plans, leading to conflicts, costs, and delays. This article breaks them down and shows how a sound plan protects your loved ones. How can you avoid these problems in 2025? Read on to safeguard your legacy.

What happens if you die without a will or trust? Your estate goes through intestate succession, where state laws—not your wishes—dictate distribution.

Why is this a problem? A judge follows default rules that often don’t align with your intentions, like splitting assets equally among children instead of prioritizing your spouse. Family conflicts erupt from disagreements, leading to resentment and lawsuits that cost thousands.

If you have minor children, the court—not you—chooses their guardian, risking someone you wouldn’t pick. Hefty tax burdens add insult, as without a trust, your estate faces unnecessary fees, reducing heirs’ inheritance by 4–7%. A simple will or trust overrides this, ensuring your voice guides the process.

What is probate and why avoid it? It’s the court-supervised validation of your will and asset distribution, often taking 9–18 months and costing 4–7% of your estate in fees.

How does it impact your family? Assets are frozen during this time, locking loved ones out of bank accounts for essentials like funeral costs, mortgage payments, or daily expenses.

The process is public, exposing your finances to scrutiny, and invites disputes among heirs. In 2025, with rising legal costs, probate can drain $10K+ from modest estates. Revocable trusts bypass probate entirely, transferring assets privately and quickly.

What does a sound estate plan include? A will names your executor and guardians, while a revocable trust avoids probate by holding assets.

These tools ensure your wishes prevail, prevent conflicts, and minimize taxes—saving heirs thousands. For example, funding a trust with your home protects it from court freezes.

Our portable, cloud-hosted trusts include free updates, making planning simple and nationwide.

Estate Plan Problems vs. Solutions

| Problem | Impact | Solution |

|---|---|---|

| Dying Intestate | Court control, family fights, wrong guardian | Will or trust to state your wishes |

| Probate | Frozen assets, delays (9–18 mo), high costs | Revocable trust for private transfer |

| Tax Burdens | 4–7% estate loss | Trusts to minimize fees and taxes |

| Minor Children Risk | Court-chosen guardian | Will naming preferred guardian |

Do I need a lawyer for a will or trust? Yes, to ensure validity—DIY options risk invalidation.

How much does an estate plan cost? Basic plans start at $1250 with us, far less than probate fees. Our 30+ years of expertise tailors plans to your needs.

Dying intestate and probate are the two biggest threats to your legacy, but a sound estate plan eliminates them. Don’t let 70% of Americans’ oversights become yours. Ready to protect your family? Schedule a free consultation below to create your plan.

John F. Davenport, founder of J. Davenport Advisors/Davenport & Associates and J. Davenport Legal in Norwalk, CT, is a licensed attorney in New York and Connecticut. As an experienced estate planning attorney and financial advisor, he has spent more than 30 years guiding clients through revocable living trusts, asset protection planning, Medicaid strategies, and tax-efficient wealth transfer, while also providing investment advisory and retirement income planning services to help families secure both their lifetime needs and their legacy for their heirs.