If you’re over 50 and wondering “Where do I even begin with retirement planning?” — you’re not alone. 62% of Americans feel behind, yet the steps are simpler than you think.

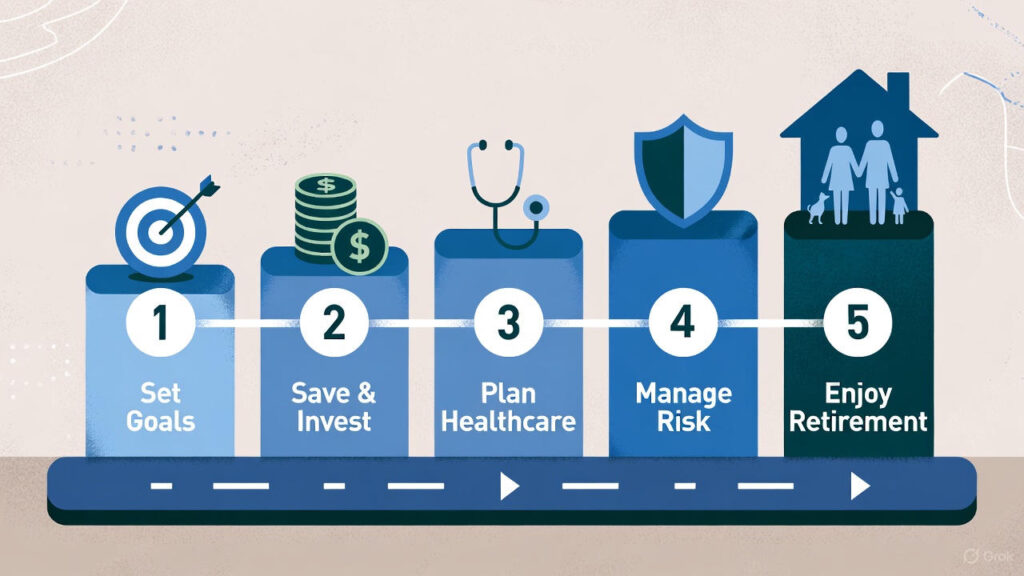

At Davenport & Associates, we’ve guided thousands of beginners to confidence in one conversation. What are the first steps in retirement planning for 2026? Five basics that anyone can follow. This article breaks them down with zero jargon. Ready to take control before the new year? Let’s go.

Ask yourself:

Why it matters: Goals drive everything else. Write it down — we’ll refine it free.

Gather:

Simple rule: Aim for 10–12× your final salary saved by retirement.

| Step | Action Today |

|---|---|

| Picture Lifestyle | Write down your dream retirement |

| Know Your Numbers | Log into accounts + ssa.gov |

| Save More | Increase 401(k)/IRA contribution |

| Create Income | Explore annuity options |

| Protect It | Schedule free review |

How much is “enough”? Most need $1M–$2M for comfort — we calculate yours free.

When should I start? Right now — every year delayed costs 10–15%.

These five steps turn “overwhelmed” into “I’ve got this.” The best time to start was yesterday — the second best is today. Ready for your personalized roadmap? Schedule a free consultation below or take our retirement readiness quiz here.

John F. Davenport, founder of J. Davenport Advisors and Davenport & Associates in Norwalk, CT, is a licensed attorney in New York and Connecticut with more than 30 years of experience as a financial advisor and investment advisor. He specializes in helping Americans maximize retirement income, explore tax-efficient strategies, implement in-plan annuity and hybrid solutions, and build lasting legacies for their heirs through thoughtful wealth planning.