Retirement planning can feel overwhelming, but it boils down to five straightforward steps anyone can follow. For most Americans, starting now ensures you enjoy the lifestyle you deserve without running out of money. At Davenport & Associates, we guide thousands through this process every year.

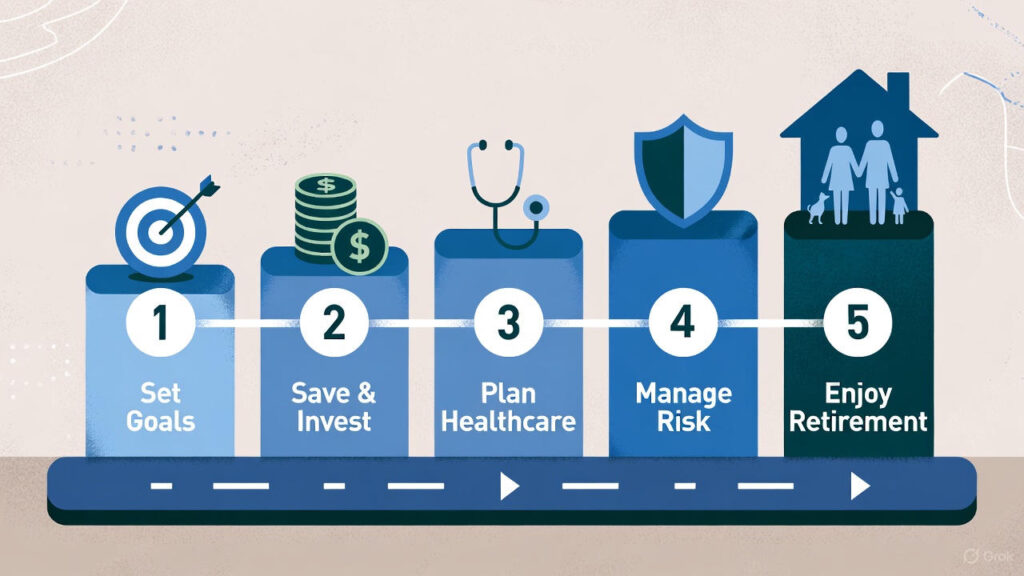

What are the five basic steps to retirement planning? They cover goals, savings, income, protection, and legacy. This beginner’s guide makes it easy. Ready to take control? Read on — your future self will thank you.

What does this mean? Decide when you want to retire, where you’ll live, and what you’ll do — travel, hobbies, family time?

Why it matters: Goals drive everything. A $80K/year lifestyle needs $2M saved (4% rule).

How to start: Write down your vision — we’ll refine it in a free review.

Key actions: Max 401(k)/IRA contributions ($23,500 base + catch-ups for 50+).

Trend in 2025: Super-catch-ups ($10,500 extra for 60–63).

Tip: Automate — even small increases compound hugely.

Beyond Social Security: Annuities for guaranteed paychecks, dividends, or rental income.

Why?: Covers essentials (housing, health) so savings last.

Our approach: Blend with Roth for tax-free growth.

Big threats: Healthcare ($315K/couple), inflation, market drops.

Solutions: HSAs, long-term care insurance, diversified investments.

Don’t forget: Legacy protection via trusts.

What it involves: Wills, trusts, beneficiary updates.

Why now?: Avoid probate (4–7% fees) and ensure heirs get more.

Bonus: Charitable gifting for tax savings.

| Step | Action Item | Start Today |

|---|---|---|

| Set Goals | Define lifestyle & timeline | Write your vision |

| Build Savings | Max contributions + catch-ups | Increase auto-deposit |

| Create Income | Explore annuities/dividends | Review options free |

| Protect Risks | HSAs & insurance | Check coverage gaps |

| Plan Legacy | Wills/trusts/beneficiaries | Schedule free review |

How much do I need? $1–2M typical for comfort — we calculate yours free.

When to start? Now — compounding is magic.

These five steps turn retirement dreams into reality. Start today — the best gift is security. Ready for your personalized plan? Schedule a free consultation below or take our retirement readiness quiz here.

John F. Davenport, founder of J. Davenport Advisors and Davenport & Associates in Norwalk, CT, is a licensed attorney in New York and Connecticut with more than 30 years of experience as a financial advisor and investment advisor. He specializes in helping Americans maximize retirement income, explore tax-efficient strategies, implement in-plan annuity and hybrid solutions, and build lasting legacies for their heirs through thoughtful wealth planning.