Picture this: You’ve built a comfortable life with a home, savings, and investments, but the thought of high estate taxes or long-term care costs draining your assets keeps you up at night.

For many Americans, an irrevocable trust could be the solution to protect your wealth and ensure it passes smoothly to your loved ones.

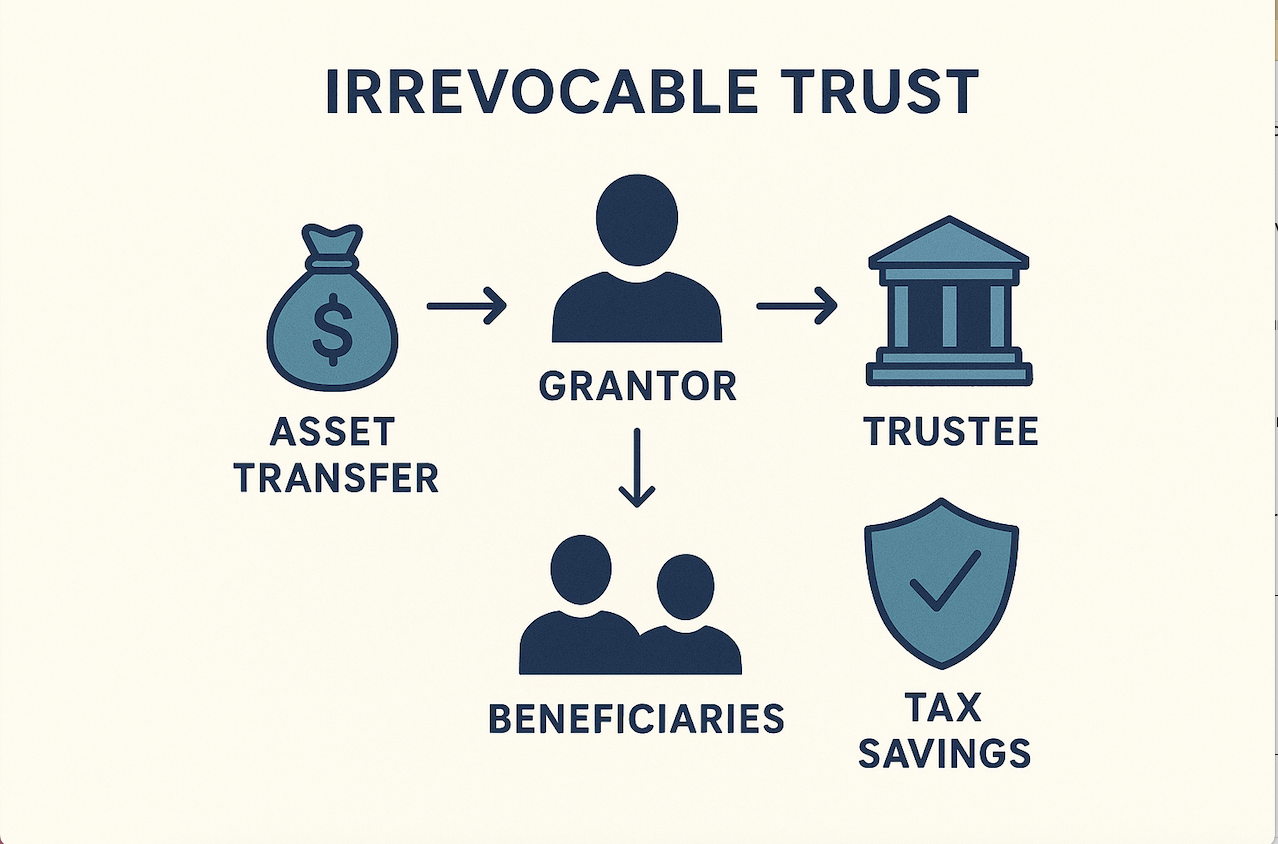

At J. Davenport Legal, we specialize in helping pre-retirees and retirees navigate these challenges. What is an irrevocable trust? It’s a permanent legal arrangement where you transfer assets out of your control to a trust, offering benefits like tax savings and asset protection.

In this article, we’ll explore what irrevocable trusts are, their key uses in 2025 estate planning, and whether they’re right for you. When should you use an irrevocable trust? Typically, when you need strong protection from creditors or to minimize taxes.

An irrevocable trust is a type of trust that, once created and funded, cannot be modified, amended, or revoked without the consent of the beneficiaries.

Unlike revocable trusts, where the grantor (you) retains control, irrevocable trusts remove assets from your estate, making them ideal for advanced planning.

This transfer is permanent, so it’s crucial to work with experienced professionals like our team at J. Davenport Legal.

How does an irrevocable trust work? You appoint a trustee (often a neutral party) to manage the assets according to your instructions, distributing them to beneficiaries as specified.

What’s the difference between revocable and irrevocable trusts? Revocable trusts offer flexibility but don’t provide the same tax or protection benefits.

Irrevocable trusts serve multiple purposes, especially for families concerned about taxes, Medicaid, and legacy preservation. Here are three primary uses:

What are common types of irrevocable trusts? Examples include irrevocable life insurance trusts (ILITs) for tax-free death benefits and charitable remainder trusts for philanthropy.

How do irrevocable trusts help with Medicaid planning? They can make you eligible for benefits by excluding trust assets from your countable resources.

What are the advantages of irrevocable trusts? They offer robust tax savings—potentially reducing estate taxes by 40% on large estates—and strong asset protection, as 70% of Americans lack plans that address these risks.

However, the main drawback is the loss of control; once assets are in, you can’t access them easily.

Are irrevocable trusts right for everyone? No, they’re best for those with significant assets facing tax or creditor threats, but they require careful setup to avoid IRS scrutiny in 2025.

Revocable vs. Irrevocable Trusts Comparison

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Flexibility | Can be changed or revoked | Permanent, hard to modify |

| Tax Benefits | Assets remain in estate | Reduces estate taxes |

| Asset Protection | Limited from creditors | Strong shielding |

| Medicaid Eligibility | Assets countable | Often excludes assets |

| Best For | Basic probate avoidance | Advanced tax/asset planning |

Can you ever revoke an irrevocable trust? In rare cases, with court approval or beneficiary consent, but it’s not straightforward.

How much does it cost to set up an irrevocable trust? Typically $3,500–$7,500 in legal fees, depending on complexity.

Our portable, cloud-hosted trusts at J. Davenport Legal include free updates for life, ensuring nationwide coverage, at a much more affordable price than above.

Irrevocable trusts provide powerful tools for tax minimization, asset protection, and controlled legacy planning in 2025.

If you’re over 50 and concerned about probate, taxes, or Medicaid, now’s the time to act. Is an irrevocable trust suitable for your family? Contact J. Davenport Legal for personalized guidance.

Schedule your free consultation today by clicking below or take our estate planning quiz to see how your current plan stacks up!

John F. Davenport, founder of J. Davenport Advisors/Davenport & Associates and J. Davenport Legal in Norwalk, CT, is a licensed attorney in New York and Connecticut. As an experienced estate planning attorney and financial advisor, he has spent more than 30 years guiding clients through revocable living trusts, asset protection planning, Medicaid strategies, and tax-efficient wealth transfer, while also providing investment advisory and retirement income planning services to help families secure both their lifetime needs and their legacy for their heirs.