You’ve created a revocable living trust to protect your legacy, but without funding it, your assets could still face probate delays and costs.

For many Americans, this oversight is common—70% of Americans lack a complete estate plan, risking family disputes and tax losses.

At J. Davenport Legal, we guide clients through funding to ensure seamless asset transfer. What does funding a trust mean? It’s transferring ownership of your assets (like real estate, bank accounts) into the trust’s name.

This article focuses on real estate transfers in 2025, with steps for other assets. Why fund your trust now? It avoids probate, saving time and money for your heirs.

Funding is the process of retitling assets from your name to the trust’s, making the trust the legal owner. For revocable trusts, you retain control as trustee, but assets bypass probate upon death.

How does funding help avoid probate? Probate can take 9–18 months and cost 4–7% of your estate, while funded trusts transfer privately and quickly.

Common assets include real estate, investments, and vehicles. Failing to fund leaves assets vulnerable, defeating the trust’s purpose.

Real estate is often the largest asset, and transferring title is key.

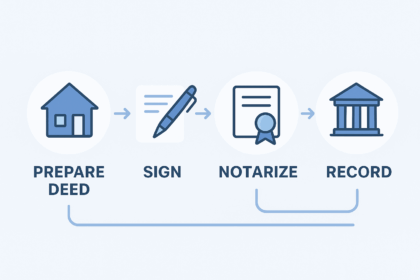

How do you transfer real estate to a trust in 2025? Start with a quitclaim or grant deed to change ownership to the trust (e.g., “John Davenport, Trustee of the Davenport Family Trust”).

Sign, notarize, and record at your county recorder’s office—fees vary by state, but it’s typically $20–$100. For mortgaged properties, notify your lender; they may approve without issues.

Our portable, cloud-hosted trusts make updates free and nationwide.

What other assets should you fund? Retitle bank accounts by visiting your bank with trust documents—change to “Your Name, Trustee of Your Trust.”

For investments (stocks, IRAs), update beneficiary designations or transfer ownership via your broker. Vehicles require DMV forms.

Life insurance can name the trust as beneficiary for tax benefits. Always review annually for new assets.

What are common funding mistakes? The biggest is not funding at all—assets remain in your name, triggering probate.

For real estate, forgetting to update during refinance can remove it from the trust.

Improper titling or missing deeds leads to delays. High-net-worth clients often overlook out-of-state properties. Work with experts like our team to avoid these pitfalls.

Steps to Transfer Real Estate to Your Trust

| Step | Description | Tips |

|---|---|---|

| Prepare Deed | Use quitclaim or grant form | Include trust name as new owner |

| Sign and Notarize | Execute in front of notary | Check state requirements |

| Record Deed | File with county recorder | Pay fees; get certified copy |

| Notify Lender/Insurer | Inform mortgage and insurance | Ensure coverage transfers |

| Update Records | Verify title change | Use for multi-state properties |

Why is funding essential in 2025? It ensures privacy (probate is public), reduces taxes, and protects from Medicaid recovery.

Trusts can save heirs thousands—probate costs average $10K+ per estate. Our free updates make it easy to maintain.

Funding your trust secures your legacy without probate hassles. If you’re over 50 and ready to transfer assets like real estate, J. Davenport Legal can help with portable trusts nationwide. Need guidance on funding? Schedule your free consultation today or take our estate planning quiz to see where you stand.

John F. Davenport, founder of J. Davenport Advisors/Davenport & Associates and J. Davenport Legal in Norwalk, CT, is a licensed attorney in New York and Connecticut. As an experienced estate planning attorney and financial advisor, he has spent more than 30 years guiding clients through revocable living trusts, asset protection planning, Medicaid strategies, and tax-efficient wealth transfer, while also providing investment advisory and retirement income planning services to help families secure both their lifetime needs and their legacy for their heirs.