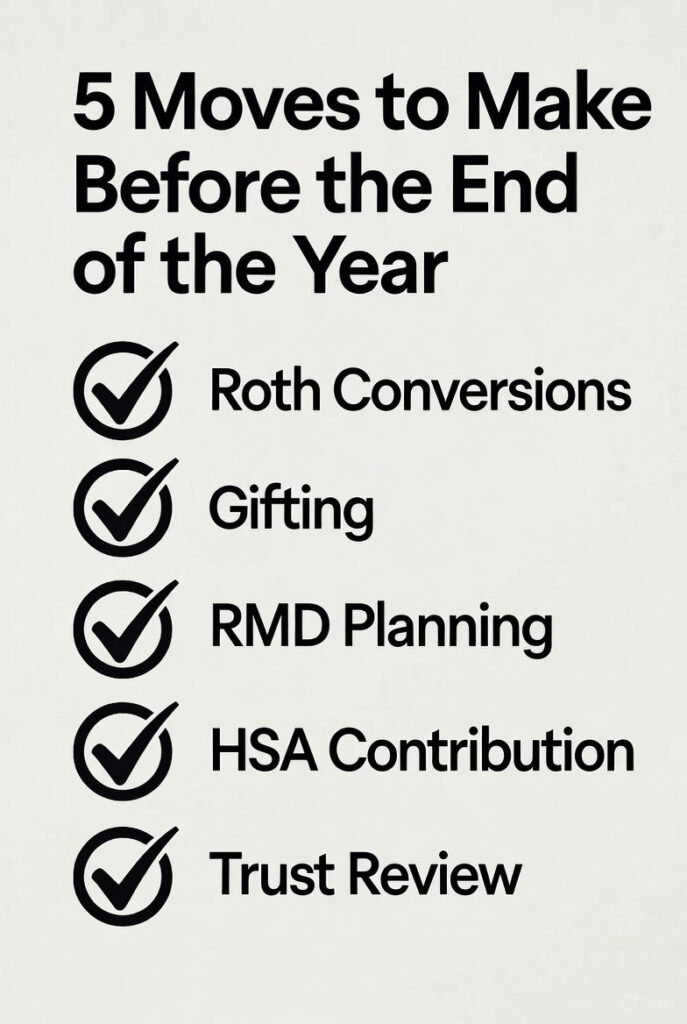

As leaves fall in October—Financial Planning Month—it’s the ideal time to prune your retirement portfolio before 2025’s tax deadlines. With 58% of Americans behind on savings and Tax Cuts and Jobs Act (TCJA) sunsets looming, year-end moves can save thousands. For most Americans, these actions secure income and legacy.

At Davenport & Associates, we guide pre-retirees through strategies like Roth conversions. What are the best year-end moves for retirement in 2025? They include RMD planning and gifting to minimize taxes. This article outlines key steps to boost security. How to prepare your retirement this fall? Read on for simple, timely actions.

What is a Roth conversion? Shift traditional IRA funds to a Roth for tax-free growth, paying taxes now at lower rates. Why in October? With potential 2025 hikes, converting $50K could save $10K long-term. For your audience? It counters the 58% savings gap, preserving more for heirs without added contributions.

How does gifting work? Give up to $18,000/person annually (2025 limit) tax-free, reducing your taxable estate. Year-end benefit? Use it for holiday gifts, avoiding the TCJA sunset’s doubled taxes. Impact? For $250K+ assets, it shields from 40% federal levies, ensuring family peace.

What are RMDs? Required minimum distributions from IRAs at age 73, taxed as income. October strategy? Calculate and plan QCDs (qualified charitable distributions) to satisfy RMDs tax-free. Why crucial? It prevents 70% of retirees from depleting savings, aligning with longevity risks.

Boost HSAs? Contribute up to $4,150 (individual, 2025) for tax-deductible savings on medical costs ($315K/couple lifetime). Fall move? Max before December 31, as it’s the last chance for 2025 deduction. Benefit? It addresses 15% budget squeeze from health priorities.

Why review trusts? Update revocable trusts for gifting or irrevocable for exemption locks before 2026. October timing? Align with Awareness Week for comprehensive checks. For security? Protects against 40% tax hits, ensuring seamless legacy transfer.

| Move | Benefit | Deadline/Action |

|---|---|---|

| Roth Conversion | Tax-free growth, $10K savings | Anytime, but plan for Q4 taxes |

| Gifting | Reduce estate by $18K/person | Dec 31, 2025 |

| RMD Planning | Tax-free QCDs | By Dec 31 for 2025 RMD |

| HSA Contribution | Triple tax break on health costs | Dec 1, 2026 for 2025 deduction |

| Trust Review | Sunset-proof asset protection | Before Jan 1, 2026 |

When to start? Now—consultants see 20% more inquiries in October. Cost? Comprehensive reviews $250, saving thousands. Our 30+ years ensure efficiency.

October’s Financial Planning Month reminds us: year-end moves build 2025 security. Don’t let 58% behind be you—act to minimize taxes and gaps. Ready for your plan? Schedule a free consultation below.

John F. Davenport, founder of J. Davenport Advisors and Davenport & Associates in Norwalk, CT, is a licensed attorney in New York and Connecticut with more than 30 years of experience as a financial advisor and investment advisor. He specializes in helping Americans maximize retirement income, explore tax-efficient strategies, implement in-plan annuity and hybrid solutions, and build lasting legacies for their heirs through thoughtful wealth planning.