What if a sudden illness left you unable to make medical or financial decisions? Without the right documents, your loved ones could face chaos and court intervention.

For every American, ancillary estate planning documents are vital complements to wills and trusts, ensuring your wishes are honored during incapacity.

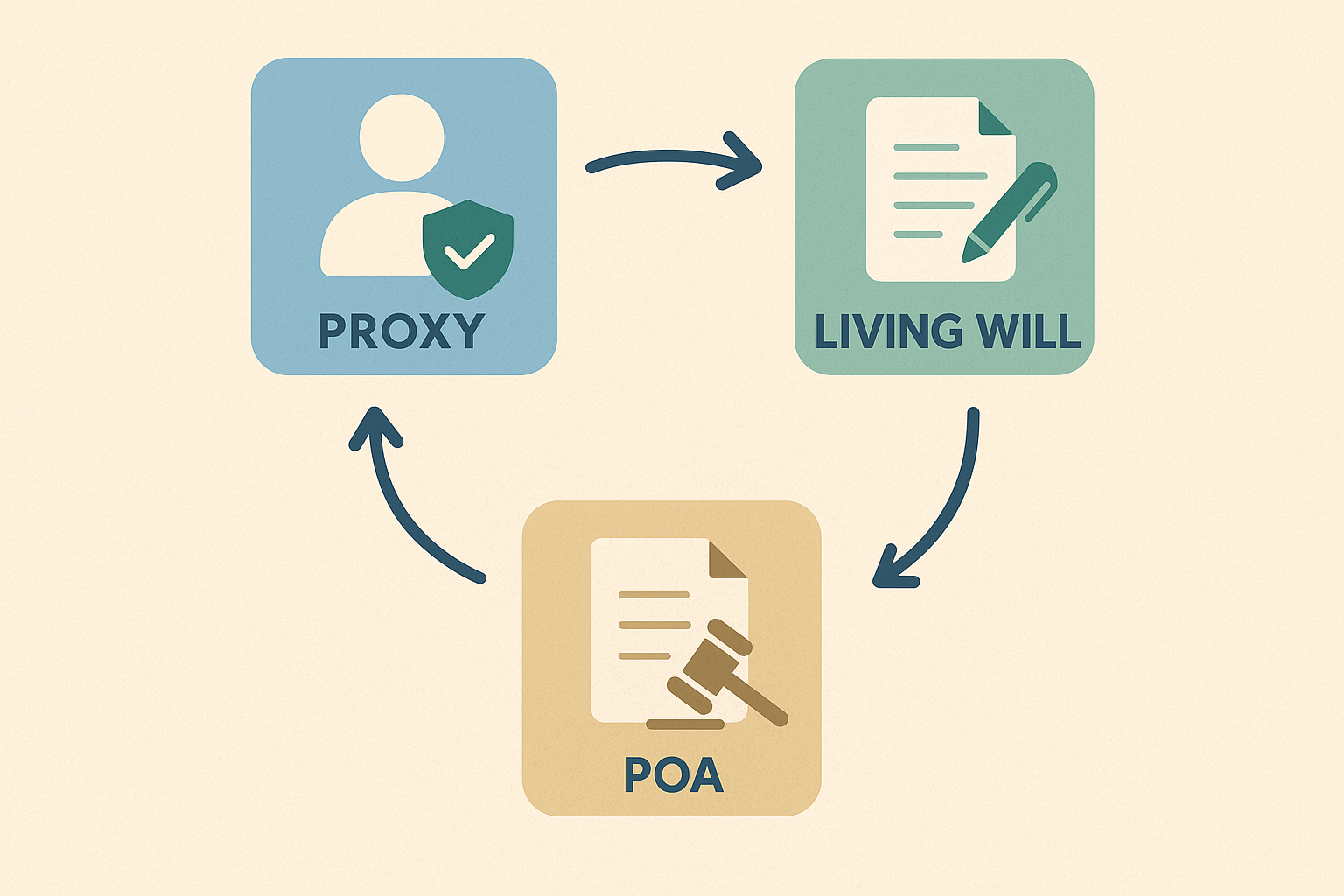

At J. Davenport Legal, we emphasize these tools in our plans. What are ancillary estate planning documents? They’re legal papers like health care proxies, living wills, and powers of attorney that handle decisions when you’re alive but unable.

Why are they crucial in 2026? With rising healthcare costs and longer lifespans, they prevent disputes and delays that affect 70% of unplanned families. This article explains each, their benefits, and why you need them now.

What is a health care proxy? It’s a document naming someone (your agent) to make medical decisions if you’re incapacitated, such as during surgery or illness.

Why is it crucial? Without one, doctors may defer to family or court, leading to delays or unwanted treatments that cost thousands.

In 2026, with advanced medical options, it ensures your preferences guide care, reducing emotional strain on loved ones. Our team drafts proxies tailored to your values, avoiding conflicts that plague 30% of families without them.

What is a living will or advanced directive? It’s a written statement specifying your preferences for end-of-life care, like life support or pain management, if you’re terminally ill or unconscious.

Why do you need it? It prevents family guesswork and guilt, as 40% of disputes arise from unclear wishes, leading to costly legal battles.

In 2026, with evolving laws on assisted care, it complements your proxy, ensuring dignity and aligning with Medicaid rules to protect assets. We integrate these into your plan for comprehensive protection.

What is a power of attorney? It grants someone authority to handle your financial and legal affairs, like paying bills or managing investments, if you’re unable. Durable POAs remain effective during incapacity.

Why is it essential? Without it, court-appointed guardianships can take months and cost $5K+, freezing assets and causing stress. In 2026, with digital banking and tax changes, a POA prevents delays that affect 50% of unprepared retirees. All of our plans come with a complimentary durable POA to ensure seamless management.

What mistakes do people make? Delaying these documents leads to 70% of estates facing probate or conflicts. Together, they form a safety net: the proxy handles health decisions, the living will guides them, and the POA manages finances. Without integration, gaps arise—our plans combine them for full coverage.

| Document | What It Does | Why Crucial |

|---|---|---|

| Health Care Proxy | Appoints medical decision-maker | Avoids delays, honors preferences |

| Living Will | Specifies end-of-life care | Prevents family disputes |

| Power of Attorney | Manages finances during incapacity | Prevents asset freezes, court costs |

Can you change these documents? Yes, they’re revocable—update them with life changes like marriage.

Do they replace a will? No, they handle incapacity; wills cover after death. Our 30+ years of expertise ensures they align.

Ancillary documents are essential to avoid incapacity chaos. Don’t risk your family’s future. Ready to add these to your plan? Schedule a free consultation below.

John F. Davenport, founder of J. Davenport Advisors/Davenport & Associates and J. Davenport Legal in Norwalk, CT, is a licensed attorney in New York and Connecticut. As an experienced estate planning attorney and financial advisor, he has spent more than 30 years guiding clients through revocable living trusts, asset protection planning, Medicaid strategies, and tax-efficient wealth transfer, while also providing investment advisory and retirement income planning services to help families secure both their lifetime needs and their legacy for their heirs.