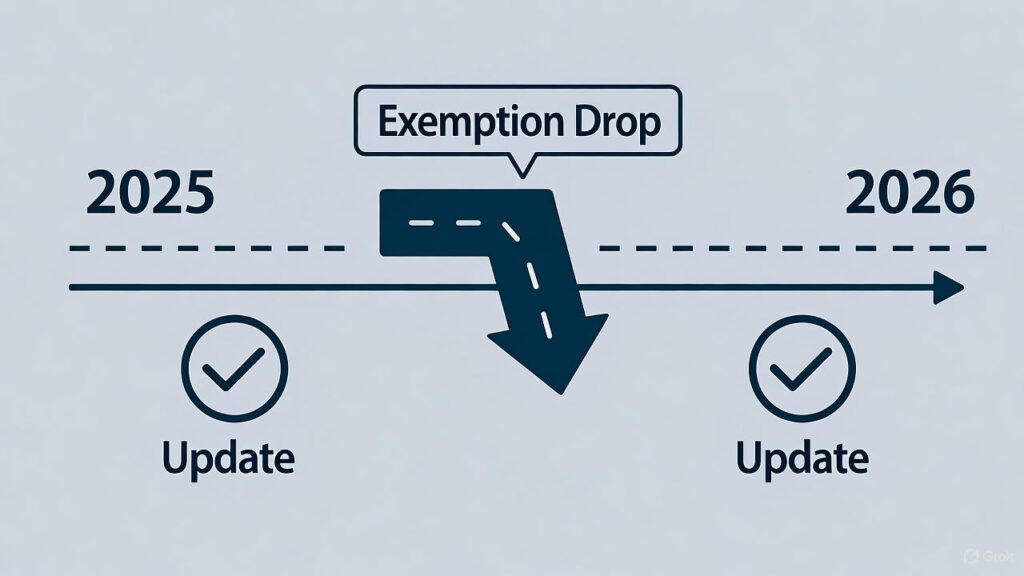

Imagine your $500,000 estate facing double the taxes in 2026, eroding what you’ve built for your heirs. For couples over 50 with $250K+ in assets, the Tax Cuts and Jobs Act (TCJA) sunset at the end of 2025 could raise estate tax exemptions from $13.61 million to just $7 million per person, hitting more families. With 70% of Americans lacking plans, this “tax cliff” risks unnecessary burdens.

At J. Davenport Legal, we help update your estate plan now to minimize impacts. What are the 2026 tax law changes for estate planning? The TCJA expiration doubles taxes on estates over the new threshold. This article explains the changes, their effects, and update strategies.

How to prepare your estate plan? Read on to act before the sunset.

What is the TCJA sunset? Enacted in 2017, the TCJA doubled the estate tax exemption to $13.61 million ($27.22 million for couples) through 2025. Post-sunset, it reverts to ~$7 million, potentially taxing 0.2% more estates. Why update now? Congress may extend or modify it, but without action, estates over $7 million face 40% federal taxes, plus state levies—up to 50% total loss. For your audience, even modest growth could trigger this.

How do changes affect families? Without updates, heirs lose 40%+ to taxes, reducing inheritance and forcing asset sales. Blended families or digital assets complicate distribution. 2026 risks? Inflation pushes values over thresholds; 70% unplanned estates face probate delays (9–18 months), amplifying costs. Updating preserves more for loved ones.

What steps to take? Review your will or trust for gifting strategies, like annual exclusions ($18,000/person in 2026). Use irrevocable trusts to lock in current exemptions. Add POAs for incapacity.

Why irrevocable trusts? They remove assets from your estate, avoiding taxes.

| Change | Impact | Solution |

|---|---|---|

| Exemption Drops to $7M | 40% tax on estates over threshold | Irrevocable trusts/gifting |

| Inflation Pushes Values | More estates taxable | Annual exclusion gifts ($18K) |

| Potential State Taxes | Up to 50% total burden | Review/update POAs/wills |

| Probate Delays | 9–18 months, added costs | Fund revocable trusts now |

When to act? Before December 31, 2025, for maximum benefit. Cost? Basic updates for new clients start as low as $250, saving thousands in taxes. Our 30+ years ensure compliance nationwide.

The 2026 TCJA sunset threatens legacies, but updating your plan locks in protections. Don’t join 70% at risk. Ready to safeguard your estate? Schedule a free consultation below.

John F. Davenport, founder of J. Davenport Advisors/Davenport & Associates and J. Davenport Legal in Norwalk, CT, is a licensed attorney in New York and Connecticut. As an experienced estate planning attorney and financial advisor, he has spent more than 30 years guiding clients through revocable living trusts, asset protection planning, Medicaid strategies, and tax-efficient wealth transfer, while also providing investment advisory and retirement income planning services to help families secure both their lifetime needs and their legacy for their heirs.